Are you looking for online education stocks to invest in, amidst the spike in the interest of students in online education? Then you have come to the right place. You will discover some of the best online learning stocks before the end of this article.

Stay Informed Group Business Team has researched and compiled a list of the best online education stocks to invest in right now. All you need to do is to read this article to the end, to find out all you need to know about the listed online learning stocks.

The education system has been hit harder by the pandemic than by online education programs. And these dynamics brought about by the new coronavirus have led many investors to online education.

School is usually not just about acquiring and retaining knowledge. It’s about getting in touch with clubs and sports and navigating buildings with hundreds or thousands of other colleagues.

Higher education has been the best place for most online educators as many of these students are working and want to pursue or add a degree during their day-to-day work and can work in school depending on the situation. Now let us give you a list of the available online learning stocks.

Read Also: Postgraduate Education: Types, Eligibility & Application Process

Why Invest In Online Education Stocks?

Online education stocks are one of the hottest areas to consider this year. It came as the need for online education grew, and the economic landscape is very diverse right now. The world we live in today is more focused on technology than traditional brick-and-mortar.

Online education has recently gained attention. Because of this, investors are starting to look for the best online education stocks they can buy right now.

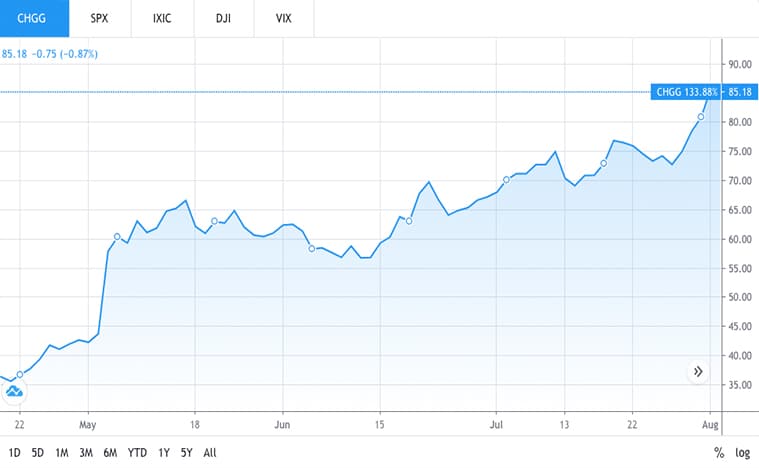

Online educational Stocks you should consider: Chegg (CHGG

The company has been very successful in maintaining a young voice as it has grown into a corporate power. The platform has programs to help staff raise money to pay off student debts beyond their salaries and has advocated important social justice issues.

Chegg has a market cap of $8 billion, so it’s no small-cap with big dreams. It’s a real company that is making great strides. CHGG’s shares are up 87% to date, and they will continue to be in the spotlight in the foreseeable future. Additionally, it could be a great acquisition target for a company looking to buy its way into the industry.

Also Read: 13 Best Digital Marketing Degree Course in 2024

Arco Platform: ARCE Online Learning Stocks

Arco has developed Western-style programs for more than 5,400 private schools serving over 1.3 million students. It provides printed and digital material for schools and students and creates a unified experience for students so that they can undertake higher education outside of Brazil if they wish.

With a market cap of $2.4 billion, it’s a major player in the space. However, the Brazilian economy is generally in a boom-bust cycle, so it can be volatile. But this is one area where parents can and will pay to keep their children updated.

ARCE stock is one of the best online learning stocks, and is currently down around 1%, but it’s a buy as the population it serves is less affected by current circumstances than the entire country.

K12 Inc – LRN

If you are looking for online education stocks that focus on online education for U.S. K-12 students, LRN stocks are for you.

Companies like K-12 Inc are known as Educational Management Organizations (EMOs), and K-12 Inc is the largest in the group.

The company was founded with funding from major political, technology, and business donors and currently has 1 million students using its online programs.

While the original goal was to create a unified curriculum for children in school in 2005, that mission has matured as technology has made online education much more accessible and convenient for students and districts’ school children.

LRN shares have started: they are up 83% in the last month alone and so far by 136%. But it’s still trading at just under $2 billion in market cap, so it’s also a great acquisition candidate when compared to other online education stocks.

The biggest challenge for the online learning stocks company is just expanding your content, which should be pretty easy. This means their margins are expected to skyrocket in the coming months and there is still plenty of growth left.

Also Read: Top 10 Business Doctoral Programs online

Universal Technical Institute (UTI

Founded in 1965, UTI operates 15 schools in the United States offering technical training programs for automobiles, trucks, marine, and racing. Some of this training can be done online, while others can be held in facilities where students work on vehicles and equipment.

Since the rooms are usually large, the students can always distance themselves socially.

Also, with traditional college campuses becoming more of a challenge now, there will be potential students who will opt for a year of technical education.

UTI stocks haven’t gotten into the online education hype, despite having risen 73% in the past 12 months, up 11% to date.

This online learning stock only has a market cap of $212 million. But keep in mind that it can be volatile.

New Oriental Education & Technology Group (EDU

It started in 2001 and has since expanded its services and base. Now it is listed in the US and has a market capitalization of around $23 billion. This makes it a fully-fledged large-cap online education stock.

EDU has been a favourite in China for quite some time as it represents a game in a major demographic in a huge market. But now it has even more advantages.

EDU stocks are up 20% and 50% over the past 12 months.

Leave a Reply